Christmas season is over and boy, my kids got more money than I do. Haha! All thanks to their grandparents, whether related by blood or a family friend, who have been generous to them over the holidays.

My kids are already at that point where they want to be in control of everything. Since they are already familiar about money, the husband and I figured that this is the perfect time to teach them concepts about money and financial management.

In other words, we want to become more involved in money-making decisions.

So, we gave them options and explained the consequences behind every option. They can:

- Open a bank account where they could save their money

- Invest it in stocks or other investment options

- Spend it

We all agreed to save a big chunk of it by opening a bank account for them and gave them a budget where they can buy whatever they want.

That being said, here are options on what to do with your kids’ Christmas money:

Option No. 1: Open a savings account.

This is the most obvious option. Starting with saving as early as now will benefit the child in the future, especially when we religiously deposit money on their account.

BDO has Junior Savers account where kids can have their own savings account with passbook for as low as P100 deposit. BPI also has Jumpstart Savings account with the same P100 deposit requirement.

Documentary requirements include (may vary depending on the bank):

- Birth certificate

- School ID, if applicable

- Passport (this will serve as their government-issued ID)

- School registration in lieu of passport

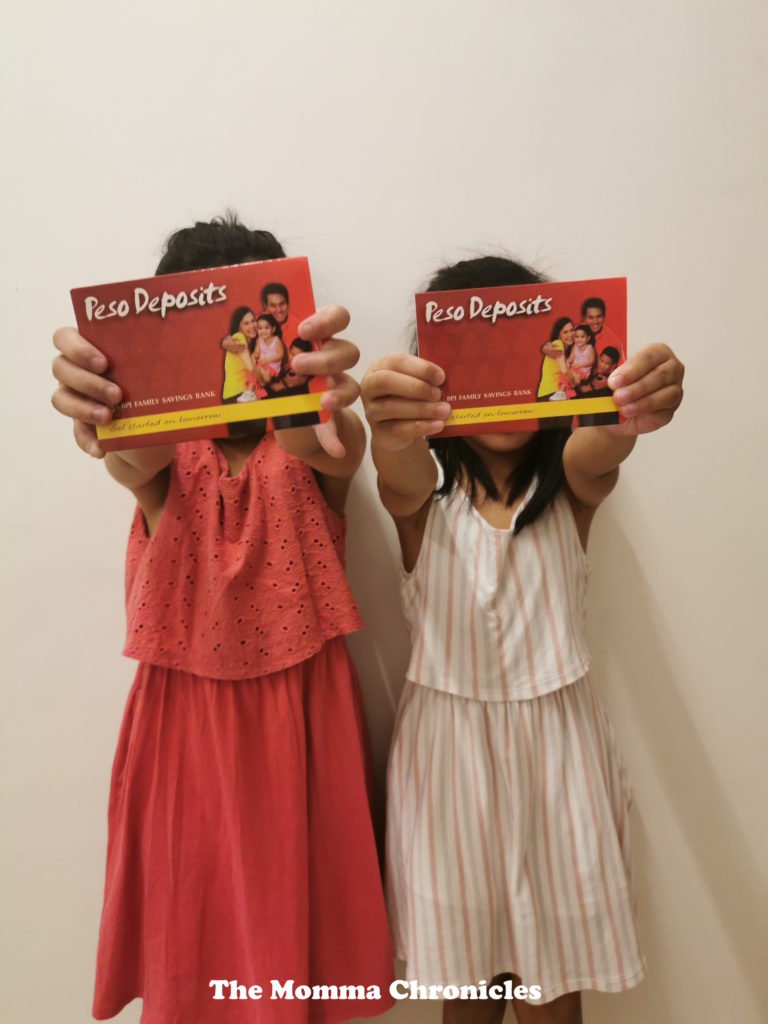

We got a regular passbook account for each kid from BPI since we prefer passbook over ATM. We felt this is safer and easier to keep as well. The kids were excited and felt “like a grown up” since they have to sign in the forms and signature cards by themselves.

It is important to keep the kids involved in this process since that will be their money. We also explained to our girls that everything their grandparents will give them will be deposited in the said account. They can get money from time-to-time AND only when needed but as much as possible, we stressed the importance of saving as well because you’ll never what will happen. It’s better to be prepared, right?

Option No. 2: Invest the money.

This is another good option to maximize the kids’ money. We thought of going for UITF or investing the money in stocks, which has higher earning capabilities than savings account.

While this sounds like a good deal, we realized that it doesn’t involve the kids in financial-decision-making. They won’t understand how the stock market works – for now – so they won’t appreciate how their money is growing.

Nonetheless, it is still a good option since who doesn’t want to grow their money?

Option No. 3: Spend the money.

I love after-Christmas shopping. Normally, malls are on sale and the prices of goods are finally lowered.

It’s okay to spend the child’s Christmas money on things s/he needs. If your kid needs new school shoes or the school bag needs replacement, then go ahead and use the money to buy a new one. You can use the cash gift to pay for the tuition fee or enroll your child in a class s/he likes.

The key here is to spend money wisely and use on things that matter.

As for us, I allowed the kids to use only a portion of their Christmas cash gift. I gave them a budget where they can buy whatever they want. In their case, they just used the money to buy new books, which is okay with me.

Option No. 4: Start the child’s Educational Fund.

I am not a believer of educational plans. Nonetheless, I do believe in the importance of having a fund specifically dedicated to the child’s education.

We all know how expensive education can be, especially when our kid studies in private schools. Instead of spending it, use the Christmas money as a buffer to pay for the child’s tuition fee next school year. It may not pay for the entire amount, but at least it will help.

Here’s the most important thing: inform your child. How to handle their money is not up to the parents’ alone. Involve your child in the decision making process, explain the options in a manner they will understand, and respect their choices.

What did you do to your kids’ Christmas money?

Ayi is a stay-at-home mom of two. When her kids are in their best state, she keeps up with chores, work, and ensuring that her sanity is intact. Join her as she navigates through this rollercoaster ride called motherhood.

0 Comments