I was 10 when I was first introduced to the concept of having a savings account. Nonetheless, I started saving earlier than that (I was 6) by keeping my allowance and getting the loose change adults don’t want. In case you’re wondering, I ended up spending all of those coins to get myself a new Barbie. Haha!

Kidding aside, the idea of saving and having my own savings account was influenced by my mom. I remember that trip to BPI Family Savings Bank outside our village so that my sisters and I could open our own accounts. My parents regularly deposit but I remember contributing a portion of my allowance as well.

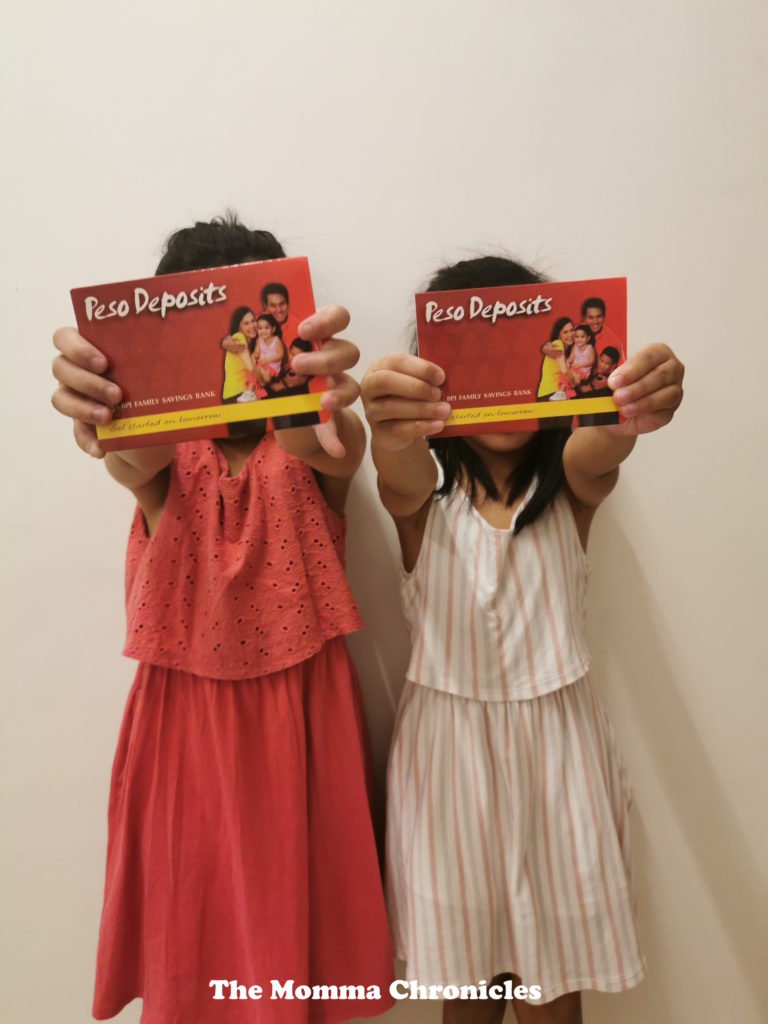

Fast forward today, it’s my kids’ turn. Since they got a handful last Christmas and familiar with these concepts, the husband and I decided it’s time for them to have their own.

Why should kids have their own savings account?

- Teaches basic Math skills like addition and subtraction

- A great tool in learning real money lessons like deposit, withdrawal, and other banking terms

- Helps build financial habits early on

- Teaches them the value of money

- Encourages kids to be more responsible with money

Opening An Account With BPI Family Savings Bank

Just like me, I also opened the kids’ first account with the same bank. In fact, I chose it for the following reasons:

- Convenience and accessibility, since the bank is few minutes away from us

- Trust and belief, since I’ve been with them since I was 10

- Hassle-free transaction

- Quality of service

Opening the kids’ saving account was hassle-free. We just submitted the following documents:

- Photocopy of birth certificate

- Photocopy of kids’ passport, which serves as their government-issued ID

- School ID

- Parent’s valid ID since the account of my youngest will be under my name

- Proof of billing, just in case

In case your child doesn’t have a passport, you can submit school registration from the school where your child is enrolled.

We were initially offered the Jumpstart Savings since this is recommended for kids. The required initial deposit is P100.00 with required balance of P1,000.00 to earn interest. Interest rate is higher at 0.5 percent.

Still, we settled for the regular Passbook Savings because we don’t want ATM; hence reducing the temptation to withdraw. Plus, we want our kids to feel that they are in control of their money and that we respect them on that. Instead of us withdrawing easily, we need to get their signature first before we can do so. This, though, has higher initial deposit but with the same interest rate per annum.

Applying was easy. We were asked to fill out the Customer Information Sheet. My eldest was asked to sign the signature card as well, where she felt giddy. I had to sign in behalf of my youngest, though, since she’s not yet seven years old.

After filling out forms, photocopying the requirements, and depositing the money, we got the passbooks and head back home. So convenient.

Banks With Savings Account For Kids

The good news is there are a lot of banks that cater to junior savers or those below 12 years old (or 17 years old, depending on the bank). This includes:

BPI Jumpstart Savings

- Minimum initial deposit: P100.00

- Interest rate: 0.25 percent p.a.

- Required balance to earn interest: P2,000.00

- Comes with ATM card

BDO Junior Savers Account

- Minimum initial deposit: P100.00

- Interest rate: 0.25 percent p.a.

- Required balance to earn interest: P2,000.00

- Comes with passbook

- Personalized EMV debit card may be requested

Metrobank’s Fun Savers Club

- Minimum initial deposit: P100.00

- Interest rate: 0.25 percent p.a.

- Required balance to earn interest: Not indicated in the website

- Comes with a passbook

EastWest’s Kiddie Savings

- Minimum initial deposit: P2,000.00

- Interest rate: 0.125 percent p.a.

- Required balance to earn interest: P2,000.00

- Comes with a passbook

Security Bank’s Junior One

- Minimum initial deposit: P100.00

- Interest rate: 0.5 percent p.a.

- Required balance to earn interest: P5,000.00

- Comes with EMV debit card and/or passbook

Chinabank’s Young Savers

- Minimum initial deposit: P100.00

- Interest rate: 0.125 percent p.a.

- Required balance to earn interest: P2,000.00

- Comes with a passbook

RCBC’s Go Savers

- Minimum initial deposit: P100.00

- Interest rate: 0.15 percent p.a.

- Required balance to earn interest: P5,000.00

- Comes with a passbook

PNB’s MyFirst Savings

- Minimum initial deposit: none

- Interest rate: 0.1 percent p.a.

- Required balance to earn interest: P5,000.00

- Comes with debit card or passbook

AUB’s Starter Savings

- Minimum initial deposit: none

- Interest rate: 0.125 percent p.a.

- Required balance to earn interest: P1,000.00

- Comes with ATM card + online banking is required

Union Bank’s Personal Savings Account

- Minimum initial deposit: none

- Interest rate: 0.1 percent p.a.

- Required balance to earn interest: P10,000.00

- Comes with Visa debit card

PSBank’s Kiddie And Teen Savers

- Minimum initial deposit: none

- Interest rate: 0.25 percent p.a.

- Required balance to earn interest: P2,000.00

- Comes with passbook and ATM card

For kids below seven, banks require that the account will be under the parent’s name and such account is “in trust for.” Your ID will also be required since the account will be under your name.

Also, most banks are into digital banking. Don’t forget to enroll your kids’ account online so you could easily track the progress.

Tips In Choosing THE Bank For Kids

- Location is key. Sure, you are eyeing on this particular bank but it will take you at least 30 minutes to get there. That is not convenient especially if you have kids in tow. The good news is banks are bringing themselves closer to where the people are. Choose a bank that is near to where you live to make banking more convenient.

- Accessibility is a must, too. Aside from location, banking must be accessible as well. Take note of the location of other branches and withdrawal machines. You’ll never know when you need cash, so it’s better to look into that as well.

- Digital banking is a requirement. Banking has never been this easy, thanks to online banking. It will be easier for you to transfer funds to your kids’ savings account just in case. Thankfully, most banks these days have online banking facilities, so this shouldn’t be an issue.

- Check for added perks. Some banks offer additional perks like insurance coverage (PSBank), medical and dental benefits, and exclusive discounts and privileges from partner stores (BPI, Metrobank) among others.

- Service. This is also important. You want to be valued and treated with respect. If you can’t feel that, then move on to the next bank and bring your money there.

So, what’s your bank of choice?

Ayi is a stay-at-home mom of two. When her kids are in their best state, she keeps up with chores, work, and ensuring that her sanity is intact. Join her as she navigates through this rollercoaster ride called motherhood.

0 Comments