I never really worried about real property taxes and other grown up stuff. Living with my parents for 23 years made my life easier and more convenient. Of course, I had to move out when I got married, which means I have to take care of my own home, including payment of property tax.

After doing some research, I found out that there is an easier way to pay for property taxes – through G-cash. Although tempting, I’m not sure if our taxes are updated so I decided to pay it myself and go directly to the Quezon City Hall.

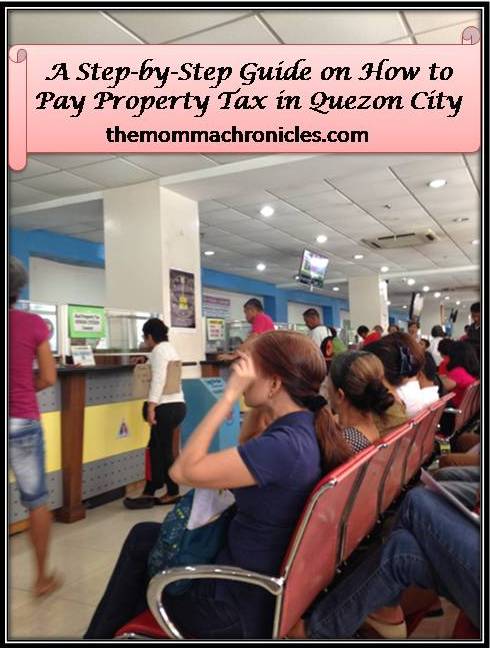

I arrived in the Quezon City Hall at 7 in the morning. The place where one has to pay property taxes is at the back building, in front of the Quezon City Public Library and just beside Landbank. From Quezon City Circle, you have to enter the Kalayaan Road then make a right turn on the first street you will see. If you see lots of people lining up, then you know you’re in the right place. I was a bit surprised because I know I’m too early. Apparently, there are more early birds than me. Lol!

In case you decide to pay for the property taxes in Quezon City Hall, here is a step-by-step guide on how to do it. 1. Go to the Assessment Lounge for assessment on how much is due. A guard will give you a number depending on the status – Current, which means your taxes are updated, Senior Citizen and Delinquent, in case you missed payments, whether for one quarter or the whole year.

2. Wait for your number to be called. There are large TV screens where you can see if it’s your turn already.

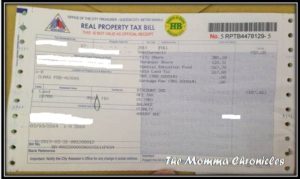

2. Wait for your number to be called. There are large TV screens where you can see if it’s your turn already.  Once your number is called, hand over the last year’s receipts. This will make it easier for the person-in-charge to check your property records. After checking, the officer-in-charge will then give Real Property Tax Bill.

Once your number is called, hand over the last year’s receipts. This will make it easier for the person-in-charge to check your property records. After checking, the officer-in-charge will then give Real Property Tax Bill.

3. Proceed to the Payment Lounge, just beside the Assessment Lounge. The guard will also give you a number. To make it easier for them, tell them if you are Regular or Senior Citizen. Then wait for your number to be called.

4. Pay the necessary fees. It’s up to you if you are willing to pay one quarter, half year or for the entire year. Just make sure to tell the person in charge during assessment so they could give you the corresponding amount.

TAKE NOTE: If you plan to pay using Manager’s Check or Cashier’s Check, make sure to write Quezon City Treasurer as the Payee and don’t forget to write the contact person and contact number at the back of the check for their reference.

That’s it. After payment, they will give you a copy of the property tax receipt as proof that you paid.

Tips when paying real property tax

- Bring necessary documents. For faster transactions, bring the last paid tax receipts. In my case, I wasn’t able to bring the last receipts so I gave a copy of the Tax Declaration and the last payment I have on hand. Good thing, the person who assisted me was nice enough to check if our property tax was paid on time.

- Be early. I arrived at 7:00am and the line is already insane. It could be because I paid on March 31, the last day for the 20% discount. Nevertheless, it won’t hurt if you arrive early since they start at 7:00am.

- Wear comfy clothes. The area is air-conditioned but with the volume of people inside, it is best to wear something comfortable.

- Don’t wait for the deadline. I was supposed to pay earlier than March 31 but because I failed to wake up early or I had other errands, I wasn’t able to pay earlier. According to the guards and employees, last day of the 20% discount, which is March 31 every year, have lots of people compared to ordinary days. To avoid long queue, pay early.

- Pay every quarter. If you can’t pay for the entire year, then at least pay before the quarter ends. Otherwise, you will be paying a penalty fee of 11%.

Note: From January to March every year, you can pay your property taxes even on Saturday or Sunday.

HERE’S GOOD NEWS!

Aside from G-Cash, online payment of real property tax is now available using LANDBANK and BANCNET ATM and Debit Card. Check out the guidelines here.

There you have it. It is recommended that we all pay the taxes due on time to avoid any penalties. I hope this post helps.

Ayi is a stay-at-home mom of two. When her kids are in their best state, she keeps up with chores, work, and ensuring that her sanity is intact. Join her as she navigates through this rollercoaster ride called motherhood.

Here in our place, paying RPT is easy. I just bring the last paid tax receipts, go to assessment and pay at the cashier. Most of the time there’s no line because I pay our tax as early as December so I can avail the 20% discount. I think discount depends sa place, kung extend pa nila.

Actually, its really easy to pay pala. It so happened lang na madami tao when I paid. Hehehe

I complete to paid my full payment last 2015 and i start to cummunicate at urban poor ( upao ) for the title and told paid the property tax equivalent to 7100k at the payment center den to the house of accesors office who assign on that squater area then they told me i pay fotr 50k or less upon and it depends to the assign man on that area. Matanong lang may babayaran kaba mismo dyan sa accesors office na ganyan halaga eh squater aRea award nmn ung lot dyan sa amin? Halos tagpi tagpi nmn mga bahay dyan bat ganyan kalaki ang computation nya. Need qo lang po ng kasagutan?

Hello Victor,

First, kanino po nakapangalan ang title ng lupa? If hindi po sainyo and gusto niyo po i-transfer sa pangalan niyo, meron po talagang mga corresponding fees gaya ng Transfer Tax and yes, medyo malaki din po ang babayaran. The amount will depend on the assessed value ng property. I suggest you ask for a breakdown of computation para po makita niyo bakit ganun ka-laki ang halaga na sinisingil.

It’s really best to pay early to avoid the long queue. 🙂

I agree 🙂

I don’t have to do this yet , thank God. But yours seem to have gone smoothly, good for you.

Okay naman 🙂 My experience went well, thankfully 🙂

Nice, detailed post. This’ll come in handy to those who plans to pay their property tax.

Nice to know. Thanks for sharing.

Thanks for sharing these helpful tips! And oh, by the way, that free coffee is a nice gesture from the QC local government.

True 🙂 I saw a lot of people lining up for it. Hehe 🙂 But the coffee machines are located in the Payments Lounge only 🙂

Thanks for the tips. I will be doing this next year.

No problem. i hope this helps 🙂

Its really best to pay property taxes ahead of time to avail of discounts 🙂

That’s true. Good thing someone introduced this. 20% is still 20%. Saves us a lot too 🙂

Ma’am iaask ko lang kung magkano naba ang amilyar sa isang taon

Hi Jhunnel. Depende po yan sa assessed value ng property mo plus penalty charges per quarter kapag hindi updated.

I find your post very helpful though I’m from Manila. Nevertheless, the process is still similar in some ways. Thanks for the tips and for sharing this post! 🙂

I think its the same din naman in all cities 🙂 Thanks!

We don’t have property under our name for now so we don’t have to do this yet. But this is a helpful guide for when we finally buy a house.

Thank you 🙂 The procedure is the same naman I think with all cities 🙂

Agree. We should not wait for due dates kasi it is so much a hassle. And better always early so maaga matapos 🙂 Ako hindi ko pa nararanasan magpay on our own ng real property pero hopefully magkaroon na din ng property 🙂

Soon mommy 🙂

We live in Taguig and we’re lucky the city hall has a satellite office in SM Aura (sosyal diba?) We were late in paying for our 2014 RPT but because we opted to settle our taxes for 2015, parang na-offset lang ng discount yung penalties.

Sosyal nga. Sana may satellite office din sa malls and QC. Hehehe. Though I have to commend QC for their counters. Parang there are 40-50 counters ata for payments alone kaya mabilis lang din 🙂

galing talaga gcash. something globe has the smart will never be able to replicate.

It’s convenient nga eh. But I haven’t tried it yet kasi I’m not sure if our taxes are updated. Will try it next time 🙂

Thanks for the tip, if I have government errands I usually go early to avoid the hassle

That’s the best way to do it. Be early 🙂

There are still a lot to improve on but in fairness, our government offices are becoming more efficient.

Hello there, just a question. Anyone know if it’s possible to pay RPT from out of the country. Like via wire transfer or online?

salamat in advance!

Hi 🙂

I checked with my friend (who is a councilor in QC). There are Philippine banks that could accommodate online payment for real property taxes. She just have to check what banks lang 🙂 But from what I know, G-cash could be another option if you can’t personally go to the city hall.

Thanks for dropping by! 🙂

if i pay in bank check, what do i write as the payee? Thanks!

Hi Jose,

That I’m not sure. I haven’t tried paying in check. I’ll ask my friend and will get back to you ASAP 🙂

Hi, just got a word from my friend. For check payment, write “Quezon City Treasurer” 🙂

Nice article.. Mejo naliwanagan ako kung pano ba to binabayaran.. Ngayon ko lang narealize na kelangan pala bayaran to taon taon.. I have a house&lot (acquired thru pre-selling).. That we moved in to last year.. The move in balance we paid already includes the basic permits/insurances and Realty Tax.. Since first time owner ako, akala ko 1 time big time lang yun.. Now that I’ve been reading more.. Narealize ko na yearly pala tong Realty tax..

My problem is.. I don’t have last year’s tax declaration or realty tax receipts.. (I’m not sure if I lost it or my agent didn’t hand it over with the other docs)..

If that’s the car.. What would be the requirements I will bring to secure this year’s payment?

Hello! Thanks for dropping by 🙂 If that is the case, you can present a photocopy of your title so that they could check and assess how much you have to pay 😊

Hello! Thanks for sharing your experience!

Is it possible to pay the tax online? I am french living in France of course and I can’t go in philippines for few years already. I noticed that the people who had to take care of my condo didnot pay neither the property tax neither the association dues! I know I will have penalties for the tax but i don’t know how much to pay and how much the penalties! any help will be appreciated ;)…

Hi!

Unfortunately, you cannot pay the realty tax online. You have to ask someone to go to the Quezon City Hall to pay the necessary expenses. As to the amount of penalties, I think it depends on the property area. Is your condo located in Quezon City? If yes, I can refer you to my good friend who happens to be a councilor in Quezon City. Maybe you can sort out an arrangement to help you pay for the real estate tax and avoid incurring further penalties 🙂

If you have further questions, you can send me an email at [email protected] and I would assist you better 🙂

Hi how about paying real property tax in in Las Pinas City Hall is it the same step guide?

Hello!

That one, I’m not sure 🙂 I think the process is also the same (assessment then payment), but to be sure, it is best to go straight to Las Pinas City Hall 🙂

Hi, It would be my first tine to pay the RPT for the house we bought since it was the developer who paid it (I hope) last time. San po ako makakakuha nung Tax Declaration? kasi right now I am still requesting for the receipt for the payment last year so I dont have any documents with me.

Hi Leo!

You can request a copy of the Tax Declaration in the City Hall na. You just have to provide them the TCT No. and you can get a certified copy of the tax declaration on the same day 🙂

Hi, I wonder qc RPT payment done by online banking is safe? Why do we need to provide PIN# of the atm ?

It should be better if they are just on the banks biller company list, just like meralco and maynilad, we only click on them for payment.

Hi Mary 🙂

To be honest, I haven’t tried the online banking facility yet. This is a new service provided by the local government, so I am not sure how this works. Nonetheless, I prefer paying directly in the City Hall to be sure 🙂

Hi Ms. Ayi,

Our condo unit in QC was turned over to us last April-2016. We have no idea if the developer already paid the RPT for 2016. Sorry to say but they are very uncooperative and won’t answer properly our emails or calls as we are currently in UAE. We don’t even know our “Tax Declaration No.” It seems we have no choice but to send our representative to QC Hall by 1st week January. Will they need the original Certificate of Title? Will there be penalties if we found that 2016 RPT was not paid? Can we pay both 2016 and 2017 RPT? Thanking you in advance.

Hi Clay 🙂 Thanks for dropping by!

To get your Tax Declaration number, simply provide the Certificate of Title number on the form (it is available in QC Hall) and they can retrieve it already. Yes, there will be penalties for non-payment of real property tax (11% per quarter * four quarters for the entire year). Nonetheless, pay for the 2016 RPT already to avoid incurring further penalty fees. As to the 2017 RPT, you can pay for the whole year already before March 31 so you can get 20% discount as well 🙂 I hope this is helpful 🙂

Thank you Ms. Ayi. Happy New Year!

Hi Ayi, thanks for your post above. 🙂

I tried using the QC online service to pay my RPT. However, I keep getting the following error: “Invalid Reference Number and Billing Type combination.”

I used the tax dec # in the following form: D-XXX-XXXXX.

Hi Cy,

To be honest, I haven’t tried the online service yet. I usually go to the City Hall and transact directly. Apologies if I cannot help you with this.

Hello, Cy.

You noted we can pay our taxes even on weekends? Is it thru their QC Hall office also? thanks!

Yes, you can pay on weekends but only up to March 31 only 🙂 That’s what the employees from the City Hall told me 🙂

Hi! we have a property named before my late parents, i am paying the taxes, pwede kaya na sa akin nakapangalan ang receipt ng paid tax?

Hi Eileen,

Normally, kung kanino nakapangalan ang Tax Declaration, dun din naka-pangalan ang tax receipts. if you want the receipts to be under your name, then the property should be under your name as well 🙂 You can do that thru extra-judicial settlement of estate 🙂

Hello Ms. Ayi,

Question lang po. Kahit pala binabayaran pa ang condo unit ko thru pag ibig eh require na pala magpay ng RPT? diko kasi alam kaya since nakuha ko yung condo ng 2014 wala pa ako binabayaran. diba dapat charge sa admin ng condo yung RPT?

Then, kung mangyari man na may babayaran kami na RPT, pwede ba kami magpaAssess even weekends?

Thank you very much.

Ellen

Hi Ellen,

Yes, you need to pay the RPT since you are the property owner 🙂 Pwede magpa-assess on weekends, but until March 31 only 🙂 After this, weekdays lang ang assessment and payment 🙂

Hi po, nawawala po kasi receipt ko nung 2015, nandito lang 2014. Okay lang po ba ito dalhin ko? Lalabas po ba sa system nila na paid ako last year (2015)? Thanks in advance.

Yes, you can bring that for reference 🙂

hello! i wonder if you could advise me with my problem… im from cavite and my husband got his pagibig housing loan.. i’m sad to say that from the start we moved in, we did not pay the real property tax..we’re not that aware of this tax we must pay when we signed the contract.. i guess we both forgot this.. and since our salary is just right to pay our expenses and this are not included.. its been 5 years and we’re afraid the amount might cost too much… would you know how much the penalty is and i read in the article that if we did not pay this on time… our property will be sold to auction? we really want to know how is it in legal matter… appreciate your respond on this… God bless!

Hi Cathyrin. I’m not sure how much is the penalty fee in Cavite, but in QC kasi, it’s 11% per quarter for every year. It is best to ask sa city hall where the property is located para sure 🙂

Hello.. Do we need TIN to pay for RPT?

Hi 🙂 No need. Just a copy of the previous RPT receipts 🙂

Hi Ayi, very informative post and with updated comments, its really helpful, BTW, taga QC din po ako ask ko lang kung nakareceived din po kayo ng “notice of assessment” saying revised revised to new Assessed Value? TIA

Hi Mick,

Thanks for dropping by and I’m glad you found the post useful. No, haven’t received that kind of notice yet. Baka kailangan lang i-assess yung value ng property to keep it updated? I’m not sure.

Just want to ask kung bakit this year ay malaki ang itinaas ng real property tax. Last year ay 1512 pesos lang ang binayaran ng mother ko, but this is ay 2800 pesos. Pangkaraniwan ba ang ganitong bayaran? Almost double. Need some advice.

Hi 🙂 The Quezon City local government passed an ordinance increasing the real property taxes by as much as 131% starting 2017. Outdated na daw kasi ang real property tax rates and the last adjustment was more than 20 years ago, that’s why tinaasan na nila ang rates. Good thing you paid before March 31, at least you were able to avail of the 20% discount.

Hi!

Thanks for the very helpful post! I’m a little bit lost coz it’s going to be my first time to pay RPT by myself hehe. Last year kasi it was coursed thru the condo developer. I just got notified that the title and tax declaration just got transferred to my name (but will be given to the bank i got a loan from) but I don’t have a copy pa (tapos the deadline for the 20% discount is in 3 weeks na! Huhu) what do i need to have with me to my rpt this assessed for the year? I only have the receipt from last year. Thanks so much!

Hi Racquel,

I’m glad you found the post helpful. You can use the receipts from last year as a reference to pay for amilyar 🙂

Hi, need to pay my rpt but dont have any receipt or documents with me what should i do now?

It would help if you know the TCT No. of the property, or at least a copy of the title to make it easier to trace the corresponding RPT.

Hello Ayi, thanks for putting this blog/site and I really find it helpful. I do have a small question regarding our lot in Tandang Sora QC. The Title has already been transferred to us around 2012. We are living in Middle East that time and we moved to Australia last 2014. We know that we need to pay the Property Tax for our property every year. The size is around 150 sqm, we are bit worried if there already enormous penalties on top of the Tax since we are not planning to have vacation in Philippines as yet. But we would like to Pay via Bank transfer, anything online is the only possibility at this point?

Hi Roger, you may check this link for online transaction – http://www.quezoncity.gov.ph/index.php/component/content/article/101/2145-easy-steps-for-online-payment-using-landbank-and-bancnet-atm-a-debit-cards

Ms Ayi,

Thank you so much for responding to every question on this thread. I also have a question. Our condo sent us a bill a while ago for Real Property Tax (RPT) 2015-2017 for only 353 pesos. This is not the usual amount I pay in QC City Hall. I wonder what is this for? Why do the Management have to bill us another RPT? As far as I remember this is the first time they sent us this kind of bill. We are living here since 2011. Thank you so much in advance. 🙂

Hi Shine. Please coordinate with the management instead. I’m not sure what the amount is for, especially if you said that it’s not the usual amount you pay in the City Hall 🙂

Hi Ayi I have a query, when one owns either condo, a lot or house and lot with Title is he/she mandatory to pay for Real Property Tax every year? Even if the condo or house and lot is for residence purposes only or the lot is empty just a lot?

Appreciate your advise.

Yes, payment of real property tax is every year. Otherwise, you will be charged with a penalty every quarter and there is also a risk of losing your property.

Is there a way for them to give an updated assessment online/thru email without the property owner going to the actual treasurers office? I saw on their website that we can pay online but that will be useless unless you know the exact amount to pay. Hope you can help! thanks!

I don’t know if the QC local government has that facility yet, but that is a good suggestion. Usually, we just go directly to the City Hall to have the property assessed.

Currently in the US at gusto magbayad ng amilyar. How do we do it from the USA? Thanks!

Hi! You can try online payment through Landbank or Bancnet ATM. Please check this for further details – http://www.quezoncity.gov.ph/index.php/component/content/article/101/2145-easy-steps-for-online-payment-using-landbank-and-bancnet-atm-a-debit-cards

Gud day! Ung lot na nbili nmen ay hnd pa nkpangalan smen pero fully paid na at ang binigay ni seller na rpt ay 2015 pa,ask ko lng kung pwd ako nlng ang mgbyad ng rpt kht hnd p nkpngalan smen ung lupa.anu2 ang mga need na documents pra mgbyad?tia!

Yes, you can pay. Just bring yung last paid na RPT receipts for reference 🙂

Dave

Good day. Kumuha ako ng condo unit 2011,fully paid 2015 including 7% Government Mandated Taxes & Other Expenses(GMTOE),na turn over sakin 2016. Wala pang Deed of Absolute Sale at Certificate of Condo Title akong natanggap sa Developer up to now. Sabi ng developer,kailangan bayaran ko muna daw yung RPT para maprocess nila Transfer Certificate of Title under my name bago nila ma release yung DAS at CCT sakin. Nagbayad ako ng RPT kasama penalties sa Parañaque treasurer’s office para sa condo unit ko pero pangalan ng Company/Developer ang nasa resibo. Tama ba na binayaran ko RPT kahit na hindi pa nakapangalan sakin unit ko? Sinabihan ako ng isang unit owner din na hindi daw ako dapat nagbayad ng RPT kase bukod sa hindi pa nakapangalan sakin unit ko,kasama na daw lahat ng expenses mula sa pambayad ng RPT,documentary stamp,pag process ng Transfer of Title hanggang sa pag issue ng DAS dun sa 7% GMTOE na binayaran ko. At dahil sa laki ng idinagdag nilang pera para sa GMTOE na binayaran ko sa developer, ire-refund daw sa’min yung sobra. Kaya ang tanong ko tama ba na pinagbayad ako ng developer ng RPT kahit na meron ng nakalaan para dito sa GMTOE at kahit na di pa nakapangalan sakin unit ko? Salamat for taking the time para maliwanagan ako dito.

Hi Dave. To transfer the title into your name and eventually the Tax Declaration, dapat updated and RPT. Since the condo is not yet under your name, sa developer pa talaga muna nakapangalan. I’m not sure kung paano ang procedure with your developer to transfer the title under your name or if included na sa GMTOE ang payment ng RPT, so I suggest that you contact them directly. Baka po kasi may process sila, so it is best to ask them para ma-clarify narin ang concerns. Thanks!

Hi I just wanna ask if bank loan ba ung house need pa din ba magbayad ng amilyar?

Hello Yan. Yes, you have to pay amilyar every year kahit naka-mortgage sa bank ang property. In fact, the bank will also require you to submit updated receipts for the said property 🙂

Mam Ayi, paano ba yung nabili kong lupa sa Caloocan isang taon na pero deed of sale lang nabayaran ko na. hindi ko na ntransfer yung title sa kin. ok lang po ba. ilang taon po kaya prescribed, allowed for me to transfer. ? Salamat po

Hi. I’m not sure about the prescription date (I think it’s 60 days), but there will be penalty fees to be paid based on the notarial date. I suggest you transfer the title under your name to avoid incurring further penalty and to avoid issues later on kasi baka may mag-contest pa sa property. Thanks!

Hi Ellen

Ngbayad ako ng RPT ng condo sa aming Admin office nung Jan 2019 tanong kailangan paba meron akong bayaran na RPT sa Quezon City Hall?

Hi Boyie! Generally, RPT must be paid in the Quezon City Hall by the property owner, unless you have a special arrangement with the admin 🙂 In that case, you should ask for a copy of the receipt to be sure that the RPT was paid 🙂

Hi Ayi is it possible to pay online?

Hi Randy! Yes it is 🙂 You can check out the guidelines on how to pay online here – http://www.quezoncity.gov.ph/index.php/component/content/article/101/2145-easy-steps-for-online-payment-using-landbank-and-bancnet-atm-a-debit-cards 🙂

good day mam. mam ask ko lang po nagavail at naaprove po ako ng condo last nov 2016. then nagbayad ako ng amilyar na good for 2 years. tuwing kailan po ba nagbabayad ng amilyar? kailan po kaya ang susunod na payment ko? sa ngayon kasi nasa saudi ako kaya di ko sya maasikaso. at plano ko kasi is magbayad na lang sa pag uwi ko this december 2018. kaya lang ang inaalala ko hindi ko alam sa binayad ko kung cover pa ng 2 years na binayad ko hanggang pag uwi ko since nagbayad kasi ako ng alanganing date which is nov. 2016. and uwi ko is dec 2018. inaalala ko kasi yung penalty. thanks a lot.

Hi Aris! You can pay the RPT every quarter (before the end of March, June, September, December), but you also have the option to pay for the entire year. It is best to pay po on or before March 31 every year to avail of the 20 percent discount 🙂 Any payment made beyond March 31 will be subjected to penalty na po.

maam kaka take out ko lang ng property na e loan ko sa pag ibig hindi ko alam kung magkano ang e babayad ko na tax amilyar at kung ano ang papakita ko sa munusipyo first time po kasi yung amount ng house nakuha ko ay 820,000

Hello Alicia! Do you have a copy of the Tax Declaration ng property mo? You can present that sa City Hall para makuha ang value ng babayaran mo na Real Estate Tax 🙂 The amount po kasi will depend on the assessed value ng property + location of the property. Hope this helps!

Hi po pano pag magbayad ako ng rpt at kukuha ako ng tax declaration..name ng asawa ko ang nasa deeds pf sale need paba ng spa ofw sya or authorization pwde na?

Hi Jai! Better to get SPA para ma-process ang pagkuha ng tax dec.

after po magbayad paano mkuha ang tax declaration???

Hi Jeny! I’m not sure about this. You can ask City Hall representatives regarding the complete list of requirements para mailipat ang tax dec under your name.

Hello, so ung Due date ng Condo property tax ko is March 31, 2019, kelan mas magandang magbayad to avail nung 20% discount? Please reply. Thanks

Hi Janice. Anytime before March 31. The earlier you pay, the better. Open din po sila every Saturday and Sunday 🙂

How about amilyar payment processing for 1st time payment is it thesame process. Is this for home owned what if condo; town hose or semi commercial home. What if deliquent payment?

Hi Dang. Same process parin, including delinquent.